December CPI: Taking Longer to Subside

January 16, 2024-

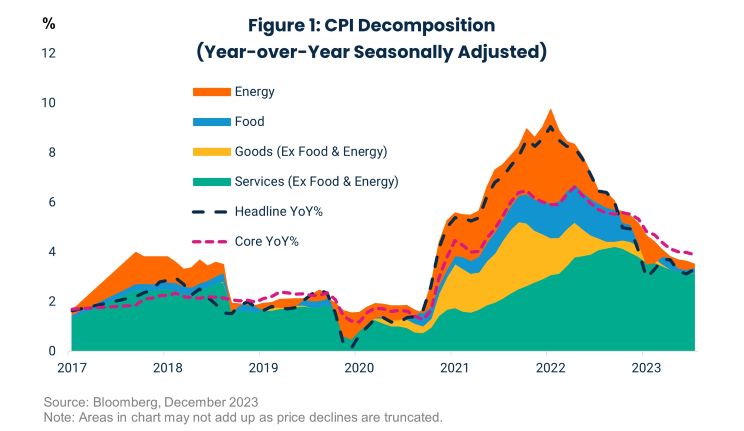

Both headline and core Consumer Price Index (CPI) surprised to the upside, nudging the chances of a Federal Reserve (Fed) cut by March lower, but doing little to stem confidence in disinflation.

-

Sector by sector, the surprises were modest, but unfortunately the signs aligned. Shelter remained firm as did core services, excluding shelter. If the January data delivers a third consecutive month of firm services prices, the Fed is likely to ratchet up its concern.

-

Goods prices were flat after 6 consecutive months of declines amid increasing vehicle prices. Further goods deflation is expected, despite growing worries about global trade patterns amid attacks in the Red Sea and drought conditions in the Panama Canal.

-

The data gives an additional data point for Federal Open Market Committee (FOMC) participants to push back against the steep path of cuts priced in markets but should not rekindle discussion of additional increases. Meanwhile, some Fed leaders have begun to discuss the end of quantitative tightening, which provides another lever for easing policy out of restrictive territory.

Headline and core inflation increased 0.3 percent month-over-month, bringing their respective year-overyear numbers to 3.4 and 3.9 percent. Shelter costs continue to run above pre-pandemic norms putting a high floor under core inflation. Shelter prices now account for around two thirds of the total increase in prices since last year. Firm price gains in the services sector beyond shelter are slowing disinflation as well with the 3-month annualized rate of core inflation stalling above 3 percent. We believe neither markets nor the Fed will panic for now, but it does raise the bar for next month’s data. We need to see further progress in the services sector, while the goods sector stays near or in outright deflation.

Flat goods prices, after several months of deflation, are more noise than signal, however, the future is more uncertain today than in previous months as weather and geopolitical concerns collide. The attacks on cargo ships traversing the Red Sea by Houthi rebels based in Yemen are diverting container ship traffic from the Suez Canal to the Cape of Good Hope. The Panama Canal is also suffering from drought conditions reducing traffic across the canal and forcing longer voyages for some cargo. So far, the effects of these issues are evident in higher shipping rates due to increased fuel use and higher insurance premiums due to the risks of both damage and longer journeys. The Red Sea issue poses broader risks to markets should it threaten all traffic crossing the Suez Canal as that is a primary transit way for energy imports to Europe or if the attacks spread to the other side of the peninsula to the Strait of Hormuz where most Middle Eastern energy is exported. Significantly higher goods and energy prices derailing central banks’ progress on inflation as a result of geopolitics would have clear echoes of the 1970s oil embargoes.

The Fed is aware of these risks and slower progress on inflation before the full effects of these issues are knowns tilts the balance of risks back towards inflation. However, despite the news in 2024, the Fed, for now, is focused on the most likely timing for the first rate cut. The odds of a rate cut by March are around 60 percent down from closer to 90 percent following the December meeting. We think the March odds should be lower given recent labor market inflation trends, as well as the increasing prominence of quantitative tightening (QT) in remarks from FOMC participants. It appears that the Committee is actively discussing when to begin tapering QT before ceasing to reduce the balance sheet behind closed doors. This is earlier than markets had anticipated, and a best guess is that they will begin tapering in May or June before ending the runoff by the fall. We expect them to release a more formal plan for how they will taper runoff ahead of the actual announcement date.

Pulling forward the end of QT allows them to be less aggressive on rate cuts as they work in the same direction on financial conditions. Interest rates are their primary tool for influencing financial conditions so pulling forward QT has the added benefit of making it easier to communicate the overall stance of policy. QT matters because it affects both the supply of liquidity in the banking sector and the amount of duration risk the private sector needs to absorb from the Treasury market. An earlier end should mean less risk of non-linear dynamics in market functioning and provides a bit more of a backstop for longterm yields. All else equal, risk sentiment should benefit and it reduces the pressure for earlier rate cuts.

For more information, please access our website at www.harborcapital.com or contact us at 1-866-313-5549.

Important Information

The views expressed herein are those of Harbor Capital Advisors, Inc. investment professionals at the time the comments were made. They may not be reflective of their current opinions, are subject to change without prior notice, and should not be considered investment advice. The information provided in this presentation is for informational purposes only.

This material does not constitute investment advice and should not be viewed as a current or past recommendation or a solicitation of an offer to buy or sell any securities or to adopt any investment strategy.

Performance data shown represents past performance and is no guarantee of future results.

This material contains forward-looking information that is not purely historical in nature. Such information may include projections and forecasts and there is no guarantee that forward-looking information will come to pass.

Investing entails risks and there can be no assurance that any investment will achieve profits or avoid incurring losses.

Harbor Capital Advisors, Inc.

3330452